Private Retirement Scheme (PRS)

The Private Retirement Scheme (PRS) is a voluntary retirement scheme designed to supplement your mandatory retirement savings. Accessible to individuals aged 18 and above, PRS offers a flexible and optional avenue for enhancing retirement planning.

Tax Incentive

|

Boost Your Retirement Savings

|

Low Sales Charge

|

Protected from Creditors

|

- AHAM Asset Management Berhad

- AIA Pension and Asset Management Sdn Bhd

- AmFunds Management Berhad

- Kenanga Investors Berhad

- Manulife Investment Management (M) Bhd

- Principal Asset Management Berhad

- RHB Asset Management Sdn Bhd

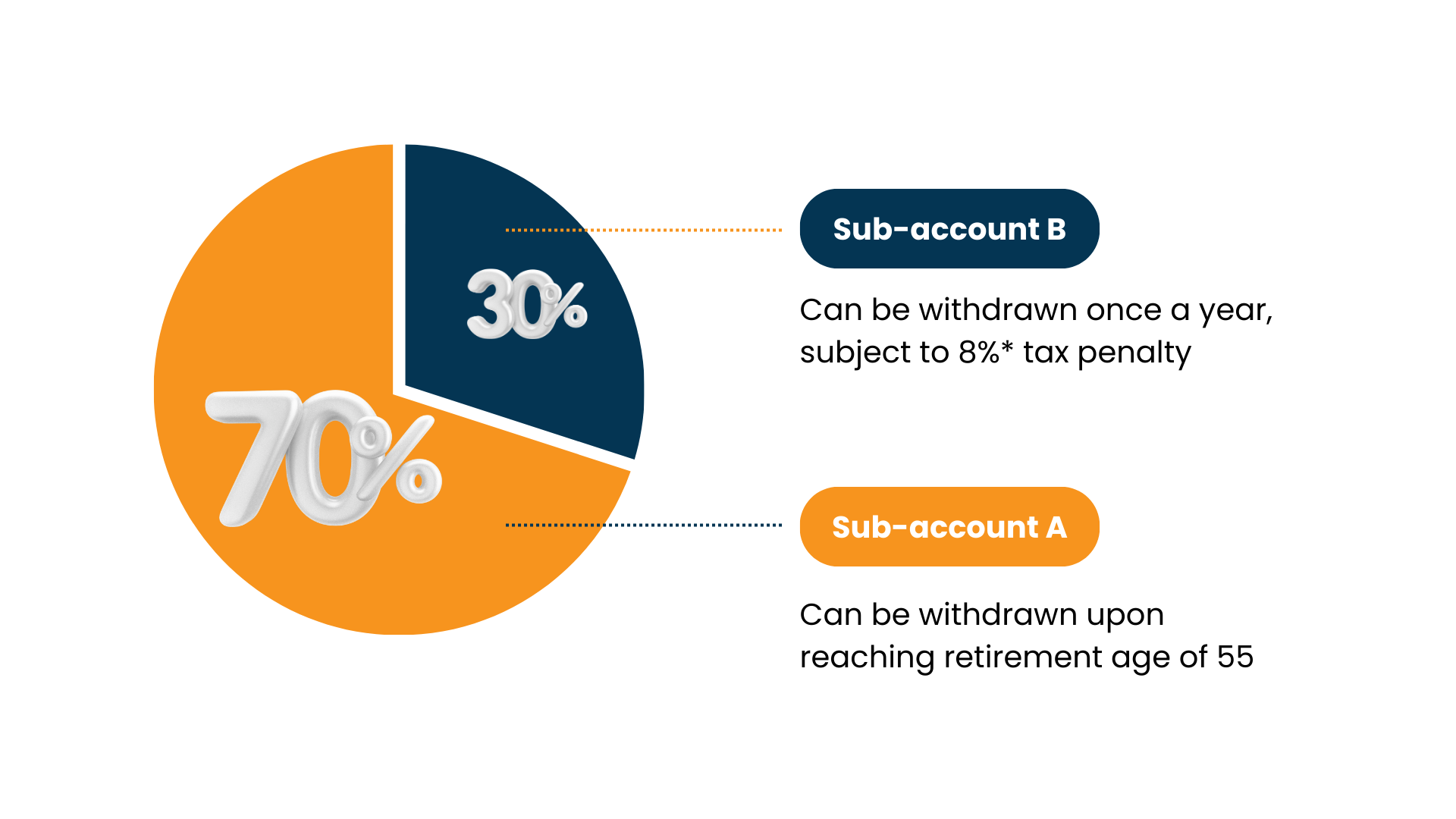

To begin, simply open a PPA (Private Pension Administrator) account for a nominal fee of RM10 to access and purchase PRS funds. All contributions are allocated to sub-accounts A and B, with their values subject to unit price fluctuations.

PRS is open to individuals aged 18 and above, including both Malaysians and foreigners.

For first-time application, you are required to submit the following document :

-

PPA Account Opening Form

-

Provider’s Account Opening Form and Transaction Form

-

A copy of Malaysian NRIC (front and back of the NRIC must be on a single page with vertical format) or passport for foreigners

-

For first-time PRS contributors, your PPA account opening must come together with PRS subscription.Please include in your payment of additional RM10 for the opening of PPA account. The purchase orders will only be processed after Phillip Mutual Berhad receives the complete documents and PPA account opening fees.

Regulated by the Securities Commission, the Private Pension Administrator (PPA) is dedicated to enhancing efficiency and convenience for PRS members. Its functions include:

-

Offering a comprehensive administrative framework for the growth and operation of the PRS landscape.

-

Facilitating member inquiries and transactions.

-

Providing PRS-related information to raise awareness and educate the public about PRS.

-

Mail-in Cheque / Cheque Deposit

-

Fund Transfer

- Account Name: PHILLIP MUTUAL BHD

- Bank Name: MAYBANK

- Account No.: 514011-379755

PRS transactions are applicable via Personal Account only.

Orders received before 12PM on a business day with all necessary documents and payments will be processed on the same day. If received after 12PM or on a non-business day, processing will occur on the next business day.

The withdrawal of PRS funds is only applicable to Account B after 1 year of your subscription. For account A, you can only withdraw upon retirement age of 55.

You will need to pay a tax penalty of 8%.

Yes, transfer to another PRS provider is allowed after one year from the first subscription date, incurring a RM25 PPA transfer fee per request and other related transfer fees if applicable.

Yes, you can switch between funds of the same provider without any fees or restrictions on the number of transactions.

Yes, you can apply RSP once you have PRS fund in your holdings.

Yes, retirees can still participate in PRS, but tax relief is subject to taxable incomes for eligibility.

You need to submit a complete set of documents to us once you have settled keyed in your transaction. It will consider as a complete set of documents once we received the form as below:

- PRS Fund provider account opening form

- PRS Fund Provider Provacy & Data Protection Act(PDPA) Form

- FIMM PRS Pre Investment Form

- Investor Suitability Assessment(ISA Form. (For AIA PRS funds, investors are required to use AIA ISA Form)

- Photocopy of Malaysian NRIC/Passport for foreigners. (The front and back of the Malaysian NRIC must be on a single page)

- MEPS FPX Direct Debit Form (If you interested on monthly deduction)

- Proof of Payment

For more information about PRS fund, please do not hesitate to contact our Client Services personnel at 603 2783 0200 or visit our nearest branch.

For more information about PRS fund, please do not hesitate to contact our Client Services personnel at 603 2783 0300 or visit our nearest branch Here.