Unit Trust is a financial vehicle that allows general public to pool their money in a ' Trust ' fund managed by professional Fund Managers who then invest the funds in a diversity of equities, bonds and other authorised investments.

Investing in unit trusts means buying the ' units ' of the trust fund. When you own even just one unit of a trust fund, you become one of the collective owners of the investments made by the Fund Managers.

Yes. 'The Capital Markets and Services Act 2007' regulates all matters relating to unit trust funds, whilst the 'Guidelines on Unit Trust Funds' governs the operations and the administration of unit trust funds. The Guidelines also provides a regulatory environment to protect the interests of the investing public and facilitate the orderly development of the unit trust industry. So, when you invest in a unit trust, you can be sure that your money is safe from theft. The Securities Commission reads and approved each unit trust's prospectus and annual report, periodically audits unit trusts' financial records, and generally makes sure everything with the fund is in order. To safeguard your investment, a Trustee is appointed for the fund. The Trustee shall take custody and control of the assets of the fund and ensure that the fund manager adheres to the requirements as set out in the trust deed.

A Deed is a set of rules on how the trust is operated, thus, it shows the rights and obligations of the Manager, the rights and duties of the Trustee and the rights of the unit holders.

Finding the right stocks to invest takes patience, resources and expertise. The number of listed companies run into hundreds so it is practically impossible for most investors to find the time adequately to make research. By investing through a unit trust, you can enjoy the benefits of having experts working on your behalf. Transaction costs are also reduced through bulk dealing. Finally, unit trusts are liquid because units can be bought or sold on any working day without any lock-in period. In short, the benefits of investing in unit trusts are Diversification, Professional Management, Liquidity and Ease of Transaction.

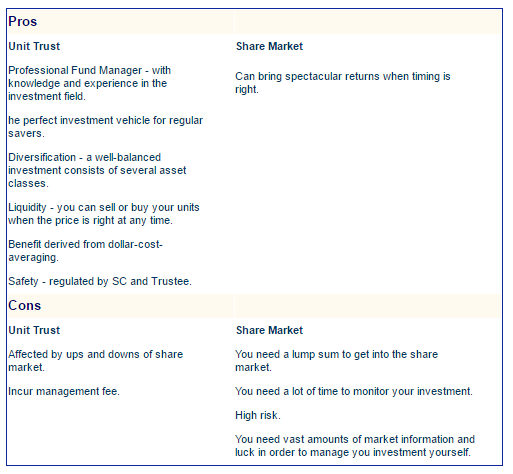

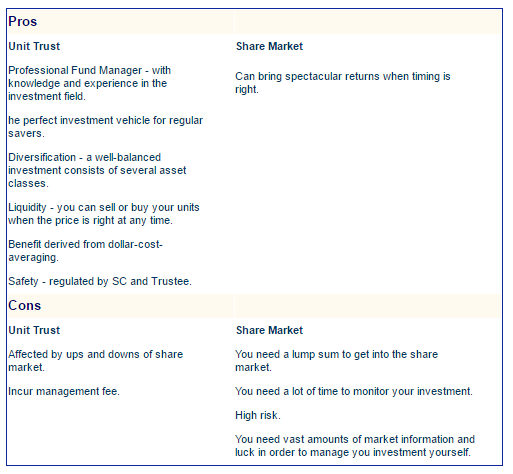

You can do it all by yourself if you have enough knowledge to analyse the market, sufficient time to monitor your investment and to do the administrative work and also a huge sum of money to diversify your investment into various sectors. Of course, to be more secure it requires expert knowledge and indeed, frequent company visits. But if you invest with us, the above mentioned tasks will be our Fund Manager's responsibility.

We believe superior long term investment performance can be achieved by exploiting inefficiencies in capital markets through vigorous and intensive research within a disciplined investment process. Even if stock markets are not performing, the depressed market presents an opportunity to buy these companies at relatively bargain price. You should understand that the fund manager is the one who needs to worry about tracking economic, political stability and uncertainty. Besides, when considering investing in a unit trust, anytime is a good time to invest, as a regular savings plan is essential to reduce the effect of market fluctuations on the average investment cost (dollar cost averaging principle).

It is a systematic and regular investment of a fixed amount of money irrespective of the price level no matter the market is rising, declining or fluctuating. This approach works on the averaging cost principle of investments; investor will get more units when prices are down and fewer units when prices are up. This method however does not assure profit nor to protect you against loss. Please refer to the illustrated example:

As seen from the illustration above, you can actually capture higher returns if you keep making the contribution at a regular interval no matter at what the price level is. It is essential in unit trust to adopt a discipline saving plan over a long-term period, so that you do not have to worry much on the market volatility.

It is fine to manage some of your money but it is also a good idea to put some money into unit trusts for diversification purposes. Your ideal portfolio should consist of equities, fixed income securities, insurance and unit trusts in appropriate weightings to suit your risk appetite.

Historically, investment in unit trusts has outperformed fixed deposits over the long term. The interest earned from fixed deposits usually is lower that it can erode capital and depreciate the purchasing power of money in longer term as the interest may not be enough to cover the tax and inflation. Though unit trust investment carries with it a higher risk, the potential for reward should be more than to compensate for it. Of course you should not forget about putting aside some money in fixed deposits for emergencies.

Investing in unit trust funds is generally affordable for most people. For example, an initial investment for our Phillip Master First Ethical Fund starts from RM 500 and its subsequent investment is only from RM 100. You may refer to our Master Prospectus to find out more on the initial and subsequent investment for other funds available.

The rate of returns depends on the fund's performance. If the fund makes little or no profit, it may not pay out any distribution. Your unit trust investment return refers to both income and capital growth where:

1.Capital growth arises from an increase in the value of the shares in the portfolio. Investors who sold the units at a higher price than the amount purchased will realise a profit and similarly investors will experience a loss if the portion of the investment sold is less than the purchase price.

2. Income return arises from dividends earned on shares and capital gains realized on the sale of shares. The distributions (if any) will be declared at the end of each financial year and will be distributed to investors based on the total units held at the end of the fund's financial year. The distributions will be paid to investors by cheque or reinvested on the investors' behalf as per the distribution policy in the prospectus.

Please note that past performance, past earnings or distribution record of the Fund are neither a guarantee nor an indication of the Fund's future performance, earnings or distributions.

You should always consider four factors i.e. your investment objectives, risk profile, investment time horizon and your affordability at any one time.

Different funds place different emphasis on the investment returns. Growth funds for instance, place more emphasis on capital gain while income funds emphasis on distribution. Fund Managers of growth fund would closely observe the objective of the fund and invest monies into selective stocks, which are geared on a long-term growth.

Unit trust management companies tend to make cash distributions or issue unit split which cause the per unit price to readjust downward. This is usually done to keep the price of each unit from looking too expensive and thus putting off new investors.

Unit split represents the process of creating additional units to existing unit holders by lowering unit prices proportionately. Like bonus issue of normal stocks, it offers no additional value to investors. However, it does, illogically, make most unitholders feel warm, fuzzy and decidedly happy.

Income earned by a fund during the financial year is accrued in its unit's price until the end of the distribution period. Upon declaration of an income distribution, any interest income and realised capital profits are paid to unitholders. Consequently, the Fund's NAV, will tend to fall by approximately the same amount as the income distribution.

Dividend income received by the fund is subject to tax, but interest income and capital gains, in general, are tax-exempted.

Fees and charges vary from fund to fund. There are fees and charges including Service Charge, Repurchase Fee, Annual Management Fee and Annual Trustee Fee . In addition, certain other expenses such as Trustee fees and brokerage expenses are borne by the fund.

Usually the two most important fees to be considered are the Initial Service Charge and the Annual Management Fee. For both, all else is being equal, the lower the better. But again, remember to compare apples with apples. Typically bond funds have lower costs than equity funds yet they also usually deliver, over the long term, less spectacular results.

You should also consider the Management Expense Ratio (MER) of a fund. MER is the ratio of the total annual management expenses of the fund to the average value of the Fund. It is the best indicators on the cost of investing in a fund and allows investors to compare the cost effectiveness of the other funds within its categories. The lower the MER, the more cost effect the fund is.

You should evaluate how a fund performs by looking at Fund Performance Tables provides by independent rating companies such as Lipper Fund Table or Morningstar Fund Table. Performance of the funds are evaluated based on the prices movement plus the changes brought about by cash distributions and unit splits within a stipulated time frame with the assumption that all distributions are reinvested.

When doing so, you must make sure that you are comparing apples with apples and not apples with durians. Make sure your comparisons are within the same category or sector.

Since unit trusts are medium-to-long-term investment instruments, pay more attention to 3-or 5-year performance and compare it to an appropriate benchmark (example: for equity funds - KLCI; for bond funds - the average Malaysian FD rate for the period under consideration) and its peer group performance. You should also look at the consistency performance of a fund.

Buying a fund that ranked top over a given period shall not be used as a sole criterion to invest in any fund. It is not necessarily the case that this fund will continue to be the best in future. For international standard, fund with 3 to 5 years track records can only be used to gauge the consistency of the performance of the fund.

' Unit Trusts ' are pure investment vehicles run by unit trust management companies whereby 'Unit-Linked Funds' are packaged products that combine unit trust investment with insurance protection. Selected insurance companies offer these hybrid products.

Apart from the fund performance and the fund manager's credibility, you should also look into the reputation and management style of a unit trust management company before making your investment choice.

Investors are becoming more sophisticated and they recognise their need to diversify their asset allocation strategy to achieve their specific financial goals. Unit trust is one of the effective tools to achieve those needs. In US and UK, there is dramatic growth of unit trust capitalization due to these countries do not have an Employee Provident Fund such in Malaysia, thus their employees have to invest in unit trusts to provide for their retirement and to satisfy other financial needs.

Phillip Master Trust Funds are the house funds managed by Phillip Mutual Berhad. There are 3 funds namely:

1.Phillip Master Money Market Fund

To provide investors with returns higher than Ringgit Malaysia (RM) savings deposits while maintaining principal value and a high degree of liquidity.

2.Phillip Master Equity Growth Fund

This Fund is to provide investors with high capital growth over the medium-to-long term through investment in high growth and situational stocks*.

3.Phillip Master Islamic Cash Fund

The Fund aims to provide investors with returns higher than Ringgit Malaysia savings deposits while maintaining principal value and a high degree of liquidity by investing in Shariah-compliant instruments.

1. Phillip MASTER Money Market Fund

Phillip MASTER Money Market Fund is your first step towards personal cash management. Generally offers higher returns than cash deposits.

There is no initial sales charge.

You get a low risk fund with instant liquidity and flexibility. You are able to withdraw money on the same day if you redeem before 9.45am or the next day if after 9.45am.

Low management fee - 0.5% per annum.

Tax-free returns - interest income from government and private debt securities are exempted from tax.

2. Phillip MASTER Equity Growth Fund

The fund is truly affordable, the initial investment is as low as RM500.

You will get a fund that gives you up to 95% equity exposure.

With active investment policy, the fund strives to maximise your potential capital growth without having you to monitor the market yourself.

3. Phillip MASTER First Ethical Fund

The fund strives to deliver competitive return for your investment over medium to long term through investments in undervalued stocks based on Socially Responsible Investment (SRI) approach, the guideline is to generate greater awareness on the impact of abuses involving tobacco, alcohol, gaming and armaments on our society. You now have the alternative to combine your financial objectives with commitment to social concerns.

The Investment Committee will conduct a 6 monthly review of stocks in the portfolio to ensure that the holdings are consistent with the principles and criteria set (which you can refer to Phillip Master Trust Funds prospectus for further details).

The fund is very affordable, the initial investment is as low as RM500.

1. Phillip MASTER Money Market Fund

If you:

seek regular income from your investment

require capital preservation

require a safer and more conservative fund

have a low risk tolerance

have a short term investment horizon

want a money market fund that complements your personal asset allocation strategy

2. Phillip MASTER Equity Growth Fund

If you:

seek medium to long term growth

have high tolerance for risk

want a growth fund that complements your personal asset allocation strategy

3.Phillip MASTER First Ethical Fund

If you:

seek maximum medium to long term growth

have a high tolerance for risk

want a growth fund that complements your personal asset allocation strategy, and which at the same time, does not go against your religious convictions and/or social concerns.

Socially Responsible Investment (SRI) combines investors' financial objectives with their commitment to social concerns such as social justice, economic development, peace or healthy environment. The objectives of SRI can be achieved through the following:

Ethical screening - the inclusion or exclusion of stocks and shares in unit trusts on ethical, social or environment grounds. Ethical screening is usually divided into 'negative screening' to exclude unacceptable shares and 'positive screening' to select companies with superior social or environmental performance.

Shareholder influence - seeking to improve a company's ethical, social and environmental behaviour as shareholder through dialogues, pressure or voting at AGMs.

Cause-based investing - supporting a particular cause or activity by financing its investment.

Gaming

Gambling addiction is a cost to the society. An US-based study concluded that as many as 10-17 people may be the victims of each compulsive gambler. Spouse, children, parents and relatives of compulsive gamblers are parties injured directly. In the work place, gambling problems lower productivity and cause inefficiency, absenteeism and theft. Two out of three compulsive gamblers will commit illegal activities in order to pay gambling related debts and to continue gambling. One of every compulsive gambler has attempted suicide. Similar study concluded that the estimated 50,000 adult compulsive gamblers cost the state USD 1.5 billion through lost work productivity, monies stolen and embezzled, bad cheques and unpaid taxes. The figure would increase significantly if the cost for social services, health care, bankruptcies, legal and correctional fees were considered.

Tobacco

Cigarettes are the only freely available consumer goods that kill. Smoking has been proven to have link to cancer and other critical diseases. The World Health Organisation (WHO) estimated that worldwide, smoking kills 11,000 people everyday. The World Bank conducted a cost analysis,

weighing the economic benefits of tobacco against the costs of premature death, medical care and sick leave worldwide. The study estimated the net loss to be $200 billion per year. The World Bank concluded, "Tobacco use is globally an economic disaster as well as an enormous economic problem in individual countries".

Alcohol

Regular heavy alcohol consumption is known to be associated with a wide range of diseases and is a significant cause of premature death. The Royal College of Physicians report summarises the impact of alcoholism to include brain damage, cerebrovascular disease, hallucinations, liver cancer, obesity, high blood pressure and fetal alcohol syndrome. Alcoholism is also known to be associated with a wide range of social problems, from crime to absenteeism and inefficiency at work.

Military Production

While national defence is necessary to maintain sovereignty and recognised in Article 51 of the United Nations Charter, it is widely acknowledge that arms proliferation breeds new cycle of violence and fresh demand for weapons. Defence expenditures limit social and economic options in many societies. The money would be better spent on health, education and human development. Over the past decades, wars and internal conflicts have claimed 5 million lives, injured 6 million children and driven 50 million people from their homes.

Performance of equivalent funds in other countries suggests that it is possible to achieve competitive returns from ethically screened shares compared to their conventional counterparts. Socially Responsible Index (DSI 400) outperforms the S&P 500 both during 2002 and on a total returns basis for 10 years for the period ending 31st December 2002 (Source: Fund Performance Update, Social Investment Forum, January 29, 2003).

In Malaysia, certain Syariah funds (a close similar investment) have been found to outperform conventional funds. The returns for Syariah based equity funds is 6.24%, whereby for conventional equity funds, concentrated on growth and income stated 5.97% returns over the period of 5 years (23rd March 1998 - 21st March 2003) - source provided by The Edge-Lipper Fund Performance Table (31st March - 6th April 2003). On the other hand, Phillip MASTER First Ethical Fund, which has less stringent guidelines than a typical Syariah fund, therefore is in a better position to provide superior performance.

Phillip Mutual provides a variety of Funds that will suit your investment need at different life and economic cycles. The Phillip Master Funds are tailored to fit in the investment puzzle of financial planning.

Phillip Capital Management Sdn Bhd is our designated Fund Manager with a combined experience of more than 20 years in fund management industry, are looking after your investment and strive to deliver competitive returns.

You will also receive the assurance and backing of a strong and globally successful name in the investment arena - The PhillipCapital Group, whose main aims is to deliver maximum returns to you.

BHLB Trustee Berhad.

You may redeem or repurchase all or some of your units held on any business day by completing the transaction form. If you have an online trading account, you may redeem your units online.

For Phillip MASTER Equity Growth Fund or Phillip MASTER First Ethical Fund, units will be redeemed at the Net Asset Value per unit of the Fund calculated at the end of the Business Day on which the request is received by the Manager.You can fax or send the form to us before 4pm on the day you wish to redeem. We will process your redemption within 10 days. You will receive your payment via mail or direct bank in to your bank account if you instruct us to do so. For Phillip MASTER Money Market Fund payment will be made on the same day if the request is received before 9.45am and the next day if after 9.45am.

For 3rd party funds distributed by Phillip Mutual Bhd, the cut-off time for redemption are as per the respective Prospectus of the Funds.

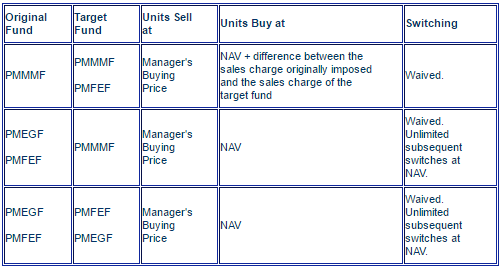

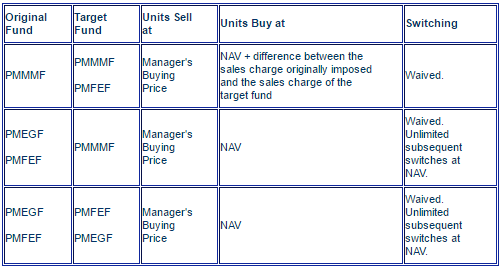

Switching provides you the flexibility to move "between" funds as often as your investment situation demands. You may switch all or some of your units held on any business day by completing the transaction form. If you have an online trading account, you may switch your units online.

For Phillip Mutual Bhd's house funds, the Units of the Fund(s) being switched (Original Fund) will be valued at the Net Asset Value of the Units whilst the units of the fund(s) with which the Units are switched (Target Fund) will be acquired at the NAV of those units as calculated in accordance with the prospectuses and deeds governing them subject to a switching fee.

If investors switch into a fund with a lower sales charge, there will be no switching fee imposed. However, if investors switch into a fund with a higher sales charge, units switched shall be subject to a fee equal to the difference between the sales charge originally imposed and the sales charge of the new fund.

The switching mechanism and the fees are summarised as follows:-

? PMMMF = Phillip MASTER Money Market Fund

? PMEGF = Phillip MASTER Equity Growth Fund

? PMFEF = Phillip MASTER First Ethical Fund

Minimum switching value must be RM1,000;

Minimum number of units left in an account after partial switching is 1000.

For 3rd party funds distributed by Phillip Mutual Bhd, the switching poliy and fees are as per the respective Prospectus of the Funds.

Yes. You may transfer fully of partially of your units in the Fund to another person by completing a Transfer Form. A transfer will be effected subject to the minimum balance of 1,000 units in your account. A transfer fee of RM20.00 will be charged for any request to transfer units.

Transfer of units must be conducted via the original signed transfer form. Online transfer is not available.

A Goods and Services Tax (GST) is a consumption tax based on the value-added concept. GST is charged on any taxable supply of goods and services made in the course or furtherance of any business by a taxable person in Malaysia. GST is also charged and levied on the importation of goods and services into Malaysia.

The GST rate to be imposed is 6 %.

Any person who makes a taxable supply for business purposes and the taxable turnover of that supply for a period of 12 months or less exceeds the threshold of RM500,000.00 is required to be registered with GST. However, business with taxable turnover of RM500,000.00 and below may choose to apply for voluntary registration.

For further enquiries, kindly refer to this official GST website:

Click Here

In Malaysia, a person who is registered under the Goods and Services Tax Act 2014 is known as a �registered person�. A registered person is required to charge GST (output tax) on his taxable supply of goods and services made to his customer. He is allowed to claim input tax credit on any GST incurred (input tax) on his purchases which are inputs to his business. Thus, this mechanism would avoid double taxation and only the value added at each stage is taxed.

Yes, Phillip Mutual Berhad is GST registered person with registration number 001683357696.

Gains or losses are not subject to GST.

Investors who invest in any of our third party funds will receive a confirmation statement from Phillip Mutual Berhad with GST information incorporated. For investors who invest in any of Phillip Mutual Berhad in-house funds, Phillip Mutual Berhad will issue a tax invoice.

The buying and selling of the units under a unit trust fund is an exempt supply therefore is not subject to GST. However, any fee based charges related to buying/selling/switching of the units such as sales or service charge, redemption fee (if the fee is for a service), switching fee, transfer fee are subject to GST at a standard rate.

With effect from 1 April 2015, Phillip Mutual Berhad will charge GST at the standard rate of 6 % (where applicable), as governed by the GST Act 2014. The table below are example of fees which may be charged by Phillip Mutual Berhad;

FPX (Financial Process Exchange) is a payment gateway operated by Payments Network Malaysia Sdn Bhd(PayNet), a national payments network with shared central infrastructure for Malaysia’s financial markets, that allows you to make real time online payments from your current or savings account which is linked to an Internet Banking account with any of the FPX participating banks.

You can transfer up to a maximum of RM300,000 per online transaction, subject to your respective Internet Banking account transfer limit.

For more details on how to increase your Internet Banking transaction limit, kindly reach out to your respective bank for more assistance.